Blog

Tag: projection

JANUARY 24, 2026 · 2 MIN READ

Assets from Spouse

Will Yip

For most households, financial decisions are shared, goals are intertwined, and assets don’t live in neat, individual silos. Yet many retirement tools still force you to plan as if only one person exists.

Read more →

DECEMBER 21, 2025 · 2 MIN READ

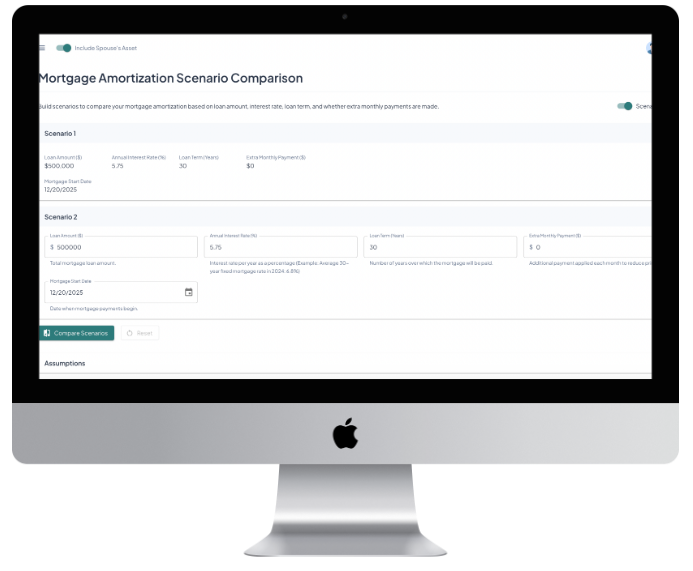

Scenario Comparison

Will Yip

We’re excited to announce a powerful new feature across all of our financial calculators: Scenario Comparison.

Read more →

DECEMBER 5, 2025 · 1 MIN READ

Overriding Projection Data

Will Yip

We have again reached another milestone towards the vision that I have set for Visually.Me - the ability to edit your projection income and investment data.

Read more →

NOVEMBER 26, 2025 · 1 MIN READ

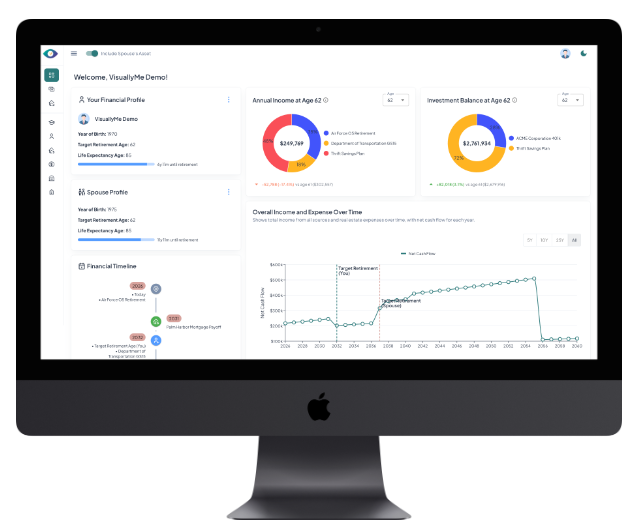

Dashboard

Will Yip

Today marks the largest and most significant update to Visually.Me since its initial debut. With this release, Visually.Me evolves from a simple projection tool into a personalized retirement planning companion.

Read more →

AUGUST 28, 2025 · 2 MIN READ

Birth of Visually.Me

Will Yip

Welcome to Visually.Me! An app that I wanted to build for my wife and I to take control of our own financial future.

Read more →